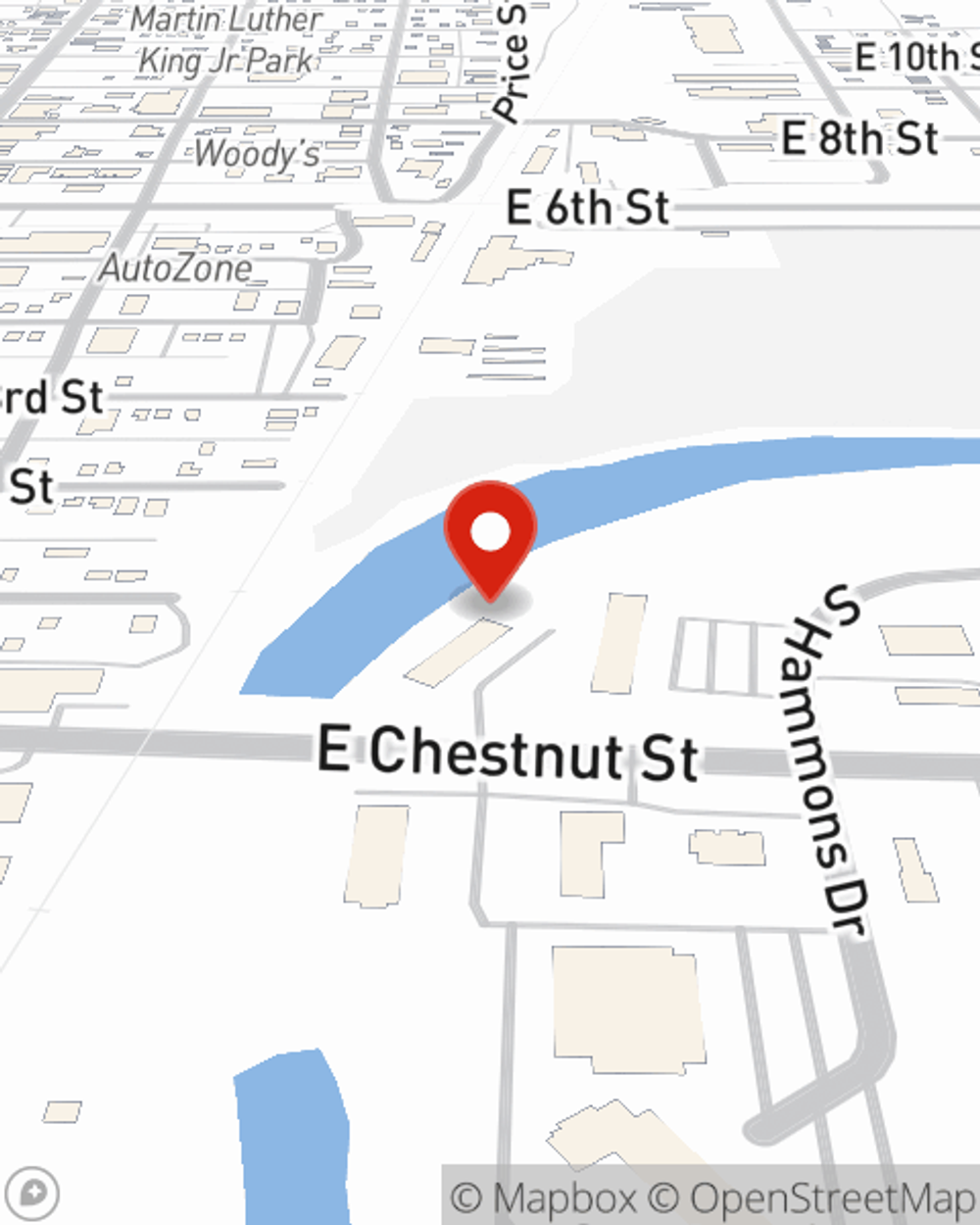

Business Insurance in and around Junction City

Get your Junction City business covered, right here!

This small business insurance is not risky

- Junction City, KS

- Fort Riley, KS

- Manhattan, KS

- Alma, KS

- Alta Vista, KS

- Milford, KS

- Dwight, KS

- Council Grove, KS

- Abilene, KS

- Ogden, KS

- Chapman, KS

- Enterprise, KS

- Wakefield. KS

- White City, KS

- Herington, KS

- Wamego, KS

Cost Effective Insurance For Your Business.

When experiencing the highs and lows of small business ownership, let State Farm take one thing off your plate and help provide terrific insurance for your business. Your policy can include options such as errors and omissions liability, extra liability coverage, and worker's compensation for your employees.

Get your Junction City business covered, right here!

This small business insurance is not risky

Small Business Insurance You Can Count On

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Heath Welch for a policy that safeguards your business. Your coverage can include everything from extra liability coverage or worker's compensation for your employees to employment practices liability insurance or group life insurance if there are 5 or more employees.

Get right down to business by contacting agent Heath Welch's team to learn more about your options.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Heath Welch

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.